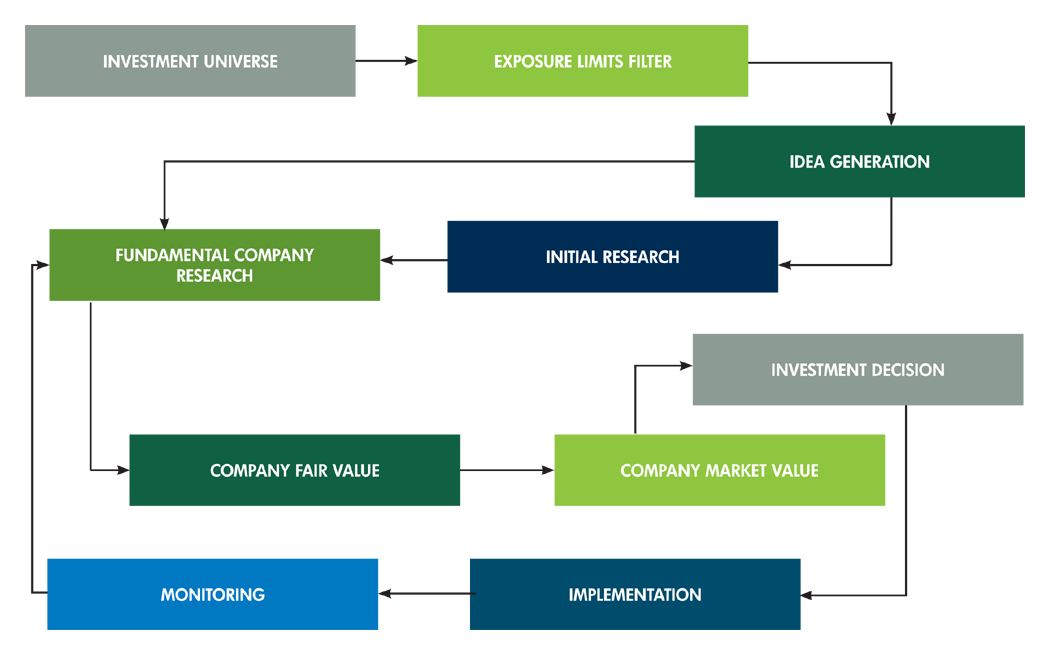

The Alpha Fund is a concentrated 15-25 stock equity portfolio that presents the opportunity to take material positions in small and medium sized companies. The aim of the investment process is to identify selected opportunities where the market price of a company has deviated materially from its fair value. Portfolio construction is driven by a disciplined, bottom-up research process with an emphasis on detailed, company-specific due diligence.

Buy-sell discipline is led strictly by valuation using a long-term investment time horizon. Investment decision-making is informed by first-hand, proprietary data. Stock selection is informed by fundamental research conducted in-situ in African countries.

A company’s position in the model portfolio is a function of the strength of the investment case, the level of conviction of the investment team, margin of safety (downside risk) and the extent of the discount (premium) to fair value.

The Africa Alpha fund will be capped at a level that allows us to continue to have the ability to make material investments in exceptional investment opportunities including small and medium sized companies.

For further information on the Africa Alpha Fund please contact us at info@sustainablecapital.mu